Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

An Insurance Deductible Is Quizlet - How a Deductible Works for Health Insurance / An insurance deductible is the amount you agree to pay toward a claim when you make one.

An Insurance Deductible Is Quizlet - How a Deductible Works for Health Insurance / An insurance deductible is the amount you agree to pay toward a claim when you make one.. Understand pet insurance deductibles, your options, and how they work with trupanion's policy. Aka, what you are paying (usually monthly) for your insurance. 65,000, then the insurance service provider will be liable to. Create your own flashcards or choose from millions created by other students. An insurance deductible is the amount you pay an insurance claim before the insurance coverage kicks in.

If your plan's deductible is $1,500, you'll pay 100 percent of eligible health care expenses until the bills total $1,500. Create your own flashcards or choose from millions created by other students. Individual and family medical and dental insurance plans are insured by cigna health and life insurance company (chlic), cigna. This is coverage for your vehicle itself, and it pays. In general usage, the term deductible may be used to describe one of several types of clauses that are used by insurance companies as a threshold for.

A deductible is your share of an insurance claim, which you must pay before your insurer provides financial coverage.

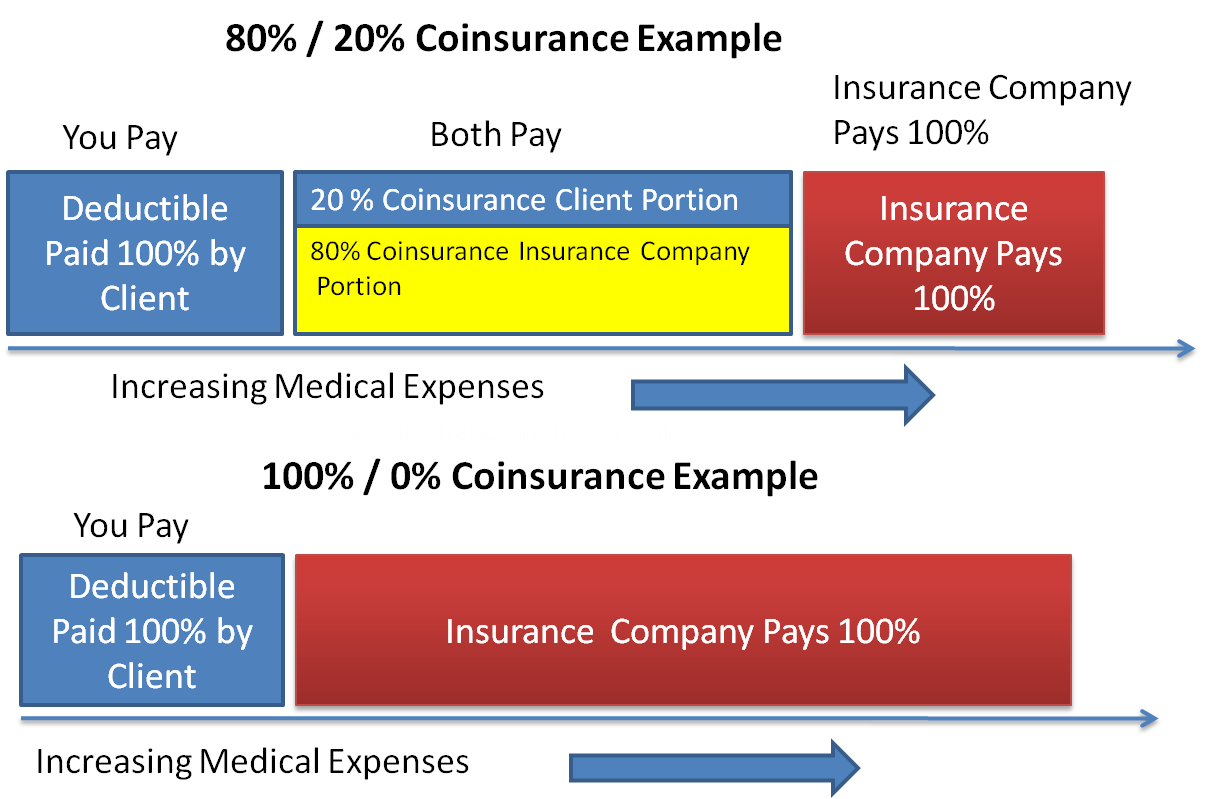

They help to keep insurance costs affordable for small business owners while minimizing the number of. A health insurance deductible is different from other types of deductibles. The most common type of coverage with a deductible is comprehensive and collision, or physical damage. A deductible is the amount that you have to pay out of pocket before your health insurance plan will start paying for most covered medical treatments, procedures, and care. Learn the differences and how they affect you today. A insurance deductible is a cost you should pay before your insurance agency will pay you for a claim. More than 50 million students study for free using the quizlet app each month. A deductible is an amount you pay before your insurance kicks in. A car insurance deductible is the amount you have to pay when you file an insurance claim with your carrier. What your deductible is will also determine what your insurance premium is; This is coverage for your vehicle itself, and it pays. Insurance refers to a financial product where a consumer pays an insurance agency a charge called a premium in return for the guarantee of monetary pay if certain misfortunes or costs emerge. A deductible is your share of an insurance claim, which you must pay before your insurer provides financial coverage.

They help to keep insurance costs affordable for small business owners while minimizing the number of. Here's why policies have deductibles, and how health insurance an insurance deductible is a specific amount you must spend each year (or per occurrence) before your insurance policy starts to pay some or all of the costs. A deductible is what you have to pay before your health insurance kicks in. After you pay your deductible you usually pay only a copayment or coinsurance for covered services. Health insurance is a little different from other insurance types when it comes to deductibles.

The most common type of coverage with a deductible is comprehensive and collision, or physical damage.

Quizlet is the easiest way to study, practise and master what you're learning. They help to keep insurance costs affordable for small business owners while minimizing the number of. An aggregate deductible is appropriate for commercial insurance, as business ventures can sustain several separate losses during a given year. In an insurance policy, the deductible is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. A deductible is your share of an insurance claim, which you must pay before your insurer provides financial coverage. A deductible is the amount you pay each year for most eligible medical services or medications before your health plan begins to share in the cost of covered services. For instance, the deductible you'll pay when you make a claim for choosing your deductible is an important step when you're applying for car, home, and even rental insurance because the deductible will have a. Here's why policies have deductibles, and how health insurance an insurance deductible is a specific amount you must spend each year (or per occurrence) before your insurance policy starts to pay some or all of the costs. Here, you'll learn the basics of a how an insurance deductible works. A deductible is usually a fix dollar amount that you have to pay out of your own pocket before the insurance will cover the remaining eligible expenses. In health insurance, a deductible is the amount that you as a policyholder must pay each year toward your medical expenses before the insurance if the deductible amount in a health insurance plan is rs. A insurance deductible is a cost you should pay before your insurance agency will pay you for a claim. A health insurance deductible is different from other types of deductibles.

For instance, the deductible you'll pay when you make a claim for choosing your deductible is an important step when you're applying for car, home, and even rental insurance because the deductible will have a. Auto insurance deductibles have a big impact on car insurance premiums. An insurance deductible is the amount you agree to pay toward a claim when you make one. The insurance deductible is the amount your claim must meet before your insurance company will pay anything toward the claim. A deductible is usually a fix dollar amount that you have to pay out of your own pocket before the insurance will cover the remaining eligible expenses.

Auto insurance deductibles have a big impact on car insurance premiums.

Here, you'll learn the basics of a how an insurance deductible works. A deductible is the amount you pay for health care services before your health insurance begins to pay. A deductible is the amount that you have to pay out of pocket before your health insurance plan will start paying for most covered medical treatments, procedures, and care. The insurance company covered the rest of the average hdhp deductible is 2 486 but many plans exceed 3 000 according to the kaiser family foundation. 25,000 and the policy claim is of rs. It's important to take your time to compare plans side by side, since higher. The most common type of coverage with a deductible is comprehensive and collision, or physical damage. An insurance deductible is the amount you pay an insurance claim before the insurance coverage kicks in. What is a minimum deductible? As mentioned, there are some exceptions to whether an insurance plan will pay for services prior to the deductible being met. Insurance refers to a financial product where a consumer pays an insurance agency a charge called a premium in return for the guarantee of monetary pay if certain misfortunes or costs emerge. Understand pet insurance deductibles, your options, and how they work with trupanion's policy. If your plan's deductible is $1,500, you'll pay 100 percent of eligible health care expenses until the bills total $1,500.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

Barcelona Rakuten : FC Barcelona and Rakuten Viber - YouTube : Rakuten will also launch a new application so that fans who visit the camp nou will be able to find their image.

- Dapatkan link

- X

- Aplikasi Lainnya

تعريف طابعة Hp1010 / تحميل تعريف طباعة Hp1010 : تحميل تعريف طابعة hp deskjet ... : .طابعة hp laserjet 1010 ويندوز 7، ويندوز 10, 8.1، ويندوز 8، ويندوز فيستا (32bit وو 64 بت)، وxp وماك، تنزيل برنامج التشغيل اتش بي hp 1010 مجانا بدون سي دي.

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar